Intro – The $12 Million Mistake

For more than two decades, trading floors across global capital markets have been forced into a false choice. Banks either invested in power-hungry physical trading towers—often costing more than $6,000 per seat once multi-monitor setups and accessories were included—or they attempted to modernize with VDI farms that quickly collapsed under the weight of latency-sensitive financial workloads. Both approaches created enormous cost distortions, operational fragility, and compliance blind spots. A modern trading desk in 2025 cannot rely on hardware refresh cycles, deskside support armies, or GPU engines hidden under desks. Yet neither can it operate effectively on legacy protocol-based VDI designed for office productivity rather than real-time analytics.

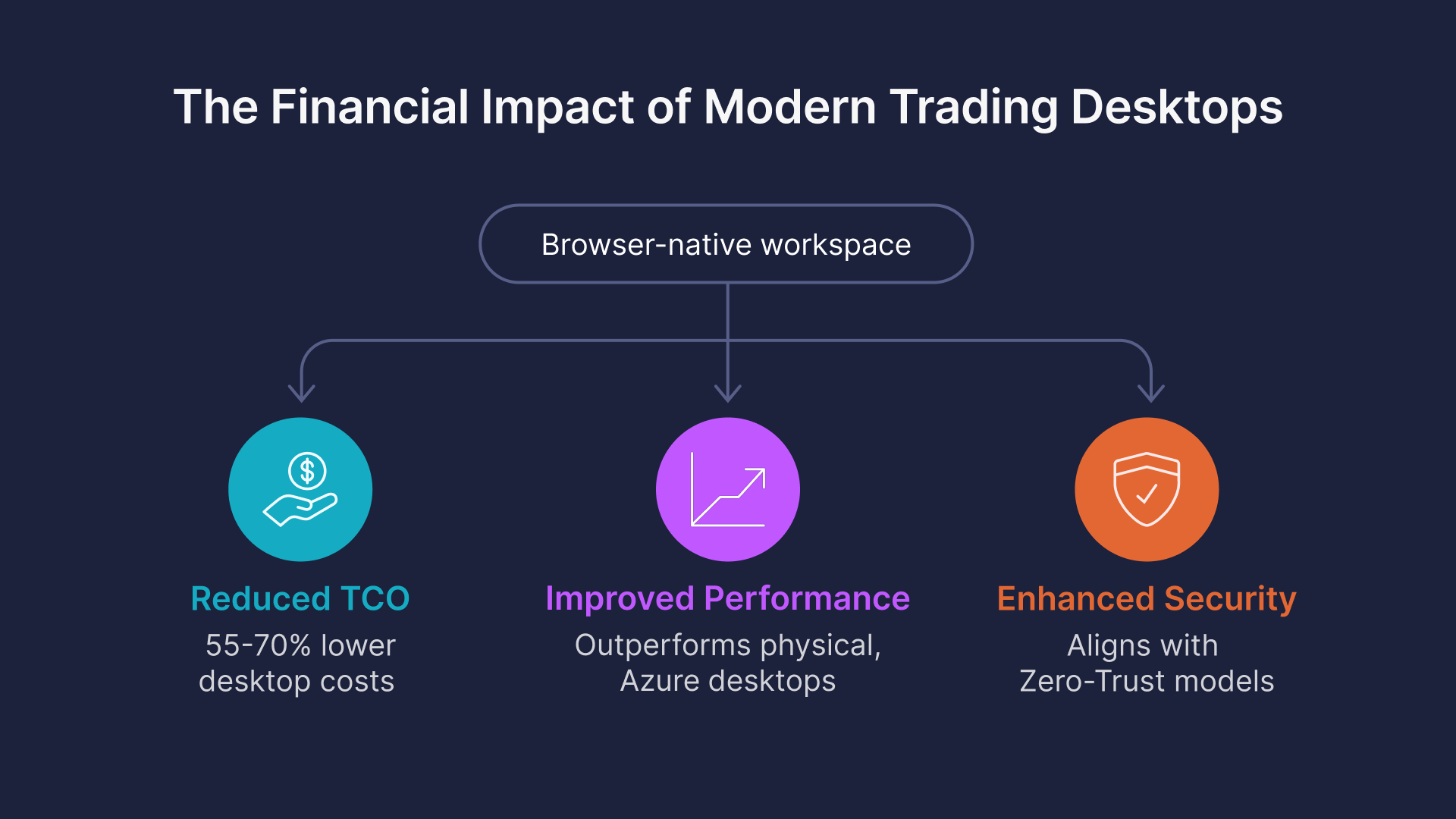

In 2025, a third option finally reached enterprise maturity: the browser-native workspace, a full Windows trading desktop delivered directly inside any HTML5 browser with GPU-grade performance, multi-monitor support, and sub-10 ms latency. When implemented on Oracle Cloud Infrastructure (OCI), this architecture reduces three-year desktop total cost of ownership by 55–70%, outperforms both physical towers and Azure-based virtual desktops, and aligns natively with SEC 17a-4 WORM retention and modern Zero-Trust security models. For capital markets firms under pressure to reduce operational overhead while supporting hybrid traders, the browser-native workspace is not merely an upgrade—it is the new baseline for financial desktop delivery.

What Is a Browser-Native Workspace?

A browser-native workspace renders the entire Windows desktop using WebGL and HTML5 canvas, eliminating the need for agents, plug-ins, VPN clients, or RDP windows. Instead of shipping powerful machines to traders or forcing them into unreliable remote protocols, everything executes within the browser itself. A trader opens Chrome, Edge, Firefox, or Safari, authenticates through the firm’s identity provider using SAML 2.0, and is instantly placed into a GPU-accelerated, Bloomberg-ready environment residing in the same OCI region as the firm’s pricing engines.

Unlike traditional VDI, the browser-native model does not depend on endpoint quality or network stability. It isolates data entirely from the device, centralizes patching and image governance, and eliminates the security exposure created by privileged trader workstations. Most importantly, it positions desktop compute next to market-data sources, OMS/EMS platforms, and risk libraries—turning desktop delivery into a structural latency advantage.

Why Capital Markets Are Returning to Centralized Desktops

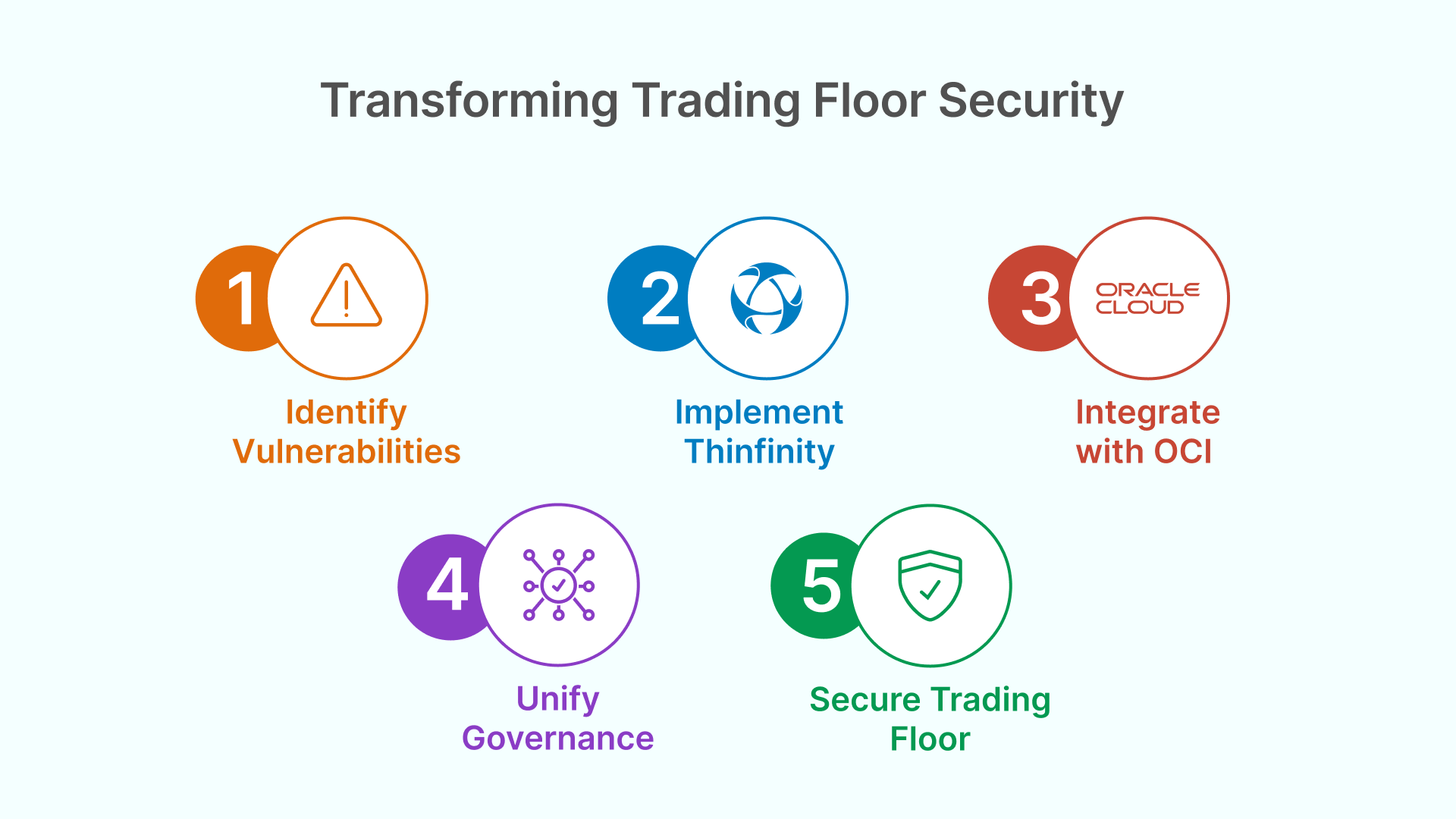

The return to centralized desktops is not a cyclical preference or a post-pandemic artifact. It is driven by five converging forces reshaping modern capital markets.

First, margin pressure has transformed desk-side hardware into a direct drag on P&L. Trading towers consume significant power, generate intense cooling demand, and require large support teams to keep them functioning. Every watt and every support ticket now matters financially.

Second, the shift toward hybrid and remote talent has redefined trader expectations. Analysts, quant teams, and desk strategists now expect identical 4K, multi-monitor, low-latency environments whether at home or in the office. Physical hardware cannot be shipped, supported, and refreshed at the pace talent models now require.

Third, reg-tech modernization has eliminated the longstanding assumption that financial organizations must preserve evidence and logs on trusted physical machines. With the SEC, FINRA, and CFTC validating cloud-native WORM storage, compliance now depends on immutable logs—not where the desktop runs.

Fourth, the speed of M&A integrations has become incompatible with physical devices. Banks can no longer take months to onboard newly acquired credit, risk, or trading teams. Browser-native desktops allow entire teams to be provisioned in hours, not quarters.

Finally, ESG accountability has made traditional trading setups difficult to defend. A single workstation with four monitors can pull 400 watts continuously. Replacing them with cloud-based GPU desktops removes massive energy costs and simplifies Scope-3 reporting.

These forces collectively make the browser-native workspace not just a technology upgrade, but an operational necessity.

Why Windows 365 and Azure Virtual Desktop Fall Short

Microsoft’s cloud desktop offerings solve part of the distribution challenge but fall short for capital markets workloads. Windows 365 introduces double licensing (Microsoft 365 + Windows 365), inconsistent GPU availability, and significant cross-cloud egress fees that can exceed $550,000 per year for a 500-seat trading desk. Azure Virtual Desktop, while flexible, struggles to deliver sub-10 ms latency for financial applications due to shared infrastructure and non-deterministic routing between regions. For trading workloads requiring tight frame pacing, predictable GPU access, and exact proximity to market-data engines, these limitations are fundamental, not incidental.

In short, Microsoft solves remote delivery but not the economic, regulatory, or performance constraints unique to trading environments.

Thinfinity on OCI — Engineered for High-Performance Trading Floors

Thinfinity’s protocol was designed to function over unpredictable networks such as airline Wi-Fi and mobile hotspots, making financial-grade fiber trivial by comparison. Instead of sending protocol commands like RDP or ICA, Thinfinity streams pixels with exceptional efficiency, ensuring a consistently smooth 60-fps experience across four 4K monitors—even during market volatility or GPU-intensive bursts. The platform supports full desktops or single applications, integrates seamlessly with OCI GPU shapes, and stores every file directly into OCI Object Storage with WORM enforcement.

This matters because it allows banks to unify audit evidence, logging, identity, storage, and session governance into a single cloud platform without installing anything on endpoints. It also eliminates the risk of privileged workstation compromise—a primary concern for trading floors with high-value targets.

Total Cost of Ownership — 500-Seat Credit Desk (3 Years)

When viewed across a full three-year cycle, the economics of desktop delivery in capital markets become unmistakably clear. Traditional physical trading towers—long treated as the presumed “safe and cost-effective” choice—now represent one of the most expensive and operationally inflexible approaches. High-performance workstations, multi-monitor 4K configurations, energy usage, cooling overhead, deskside engineering labor, and endpoint-level compliance tooling collectively push the true TCO for a 500-seat trading floor to more than $7.6 million over three years. This model also locks firms into rigid refresh cycles and complex hardware logistics that cannot keep pace with hybrid work or rapid M&A onboarding.

Cloud-hosted desktops such as Windows 365 attempt to modernize this footprint, but their economics break quickly for front-office workloads. Double licensing, GPU uplift charges, quota constraints, and large egress fees push the three-year cost of a 500-seat trading environment to $12.5 million, making it the least cost-efficient option for teams requiring deterministic GPU performance and sub-10 ms latency.

Thinfinity on Oracle Cloud Infrastructure offers a structurally different cost profile. By delivering compute, GPU acceleration, storage, identity, and compliance through a centralized browser-native architecture, firms eliminate workstation refreshes entirely, remove deskside support from the equation, and eliminate the power and cooling footprint associated with hundreds of physical trading towers. Every desktop runs inside OCI next to market-data sources and pricing engines, reducing both latency and operating cost. The result is a predictable three-year TCO of $3.5 million for the same 500-seat desk.

Across the full comparison, the financial outcome is definitive. A browser-native workspace on OCI is 55–70% less expensive than physical trading towers and more than 70% cheaper than Windows 365 with GPU. Most firms reach breakeven in month 11, with savings compounding over time as teams scale or consolidate.

Three-Year TCO Comparison — 500 Trading Desktops

| Deployment Model | 3-Year Cost | Operational Profile | Financial Impact |

|---|---|---|---|

| Physical Trading Towers | $7.6M | High energy usage, intensive deskside support, rigid refresh cycles, complex compliance footprint | Most expensive on-prem option; operationally inflexible |

| Windows 365 + GPU | $12.5M | Double licensing, GPU quota limits, large data egress fees, variable performance | Highest cost; not viable for latency-sensitive workloads |

| Thinfinity on OCI | $3.5M | Browser-native delivery, no endpoint hardware, no VPN, WORM storage, autoscale GPU | Lowest cost; fastest to deploy; built for hybrid trading |

Security and Compliance — Built Around Zero Trust

The browser-native architecture eliminates the endpoint as a security variable. No files are stored locally. No privileged access exists on the trader’s machine. All images are centrally hardened, patched, monitored, and governed. Session activity, logs, replay files, and encryption keys are stored immutably within OCI, aligning natively with SEC 17a-4, FINRA 4511, and CFTC 1.31. OCI Cloud Guard enforces micro-segmentation, threat detection, and continuous configuration monitoring, while identity access is centrally enforced through SAML or OIDC.

This reduces both regulatory burden and cyber risk, particularly in hybrid workforce models where unmanaged home networks introduce new attack surfaces.

Latency — Always Under 10 ms

A major advantage of running browser-native desktops in OCI is their placement directly alongside pricing engines, tick data stores, OMS/EMS workflows, and real-time risk libraries. By keeping everything inside the same region, network distance collapses, leading to sub-9 ms latency even at the 99th percentile. Thinfinity’s WebGL rendering engine maintains stable 60-fps performance across four 4K monitors, providing a fluid trading experience indistinguishable from a high-end tower.

This is not simply a technical achievement; it removes one of the last perceived barriers to cloud desktops in finance.

A 90-Day Path to Production

Most financial organizations deploy browser-native desktops in approximately 90 days. The first phase establishes the OCI landing zone, identity integration, network segmentation, and FastConnect connectivity. The second phase focuses on building a standardized golden image that includes Bloomberg, Refinitiv, Excel libraries, analytics plugins, and any internal risk tooling. The third phase introduces Thinfinity’s dual-gateway architecture, autoscaling groups, and SAML federation. After a controlled 50-user pilot and compliance validation, firms proceed with staged production rollout.

This structured approach reduces operational risk and ensures that performance, compliance, and user experience meet or exceed expectations before any wide-scale transition.

Exit Freedom — No Lock-In, Full Portability

Unlike proprietary VDI stacks or cloud desktop services, a browser-native workspace on OCI retains full asset portability. Virtual machines export as VHD files, audit logs as JSON, session recordings as MP4, and all identity relationships remain governed through standards-based SAML or OIDC. Firms maintain complete sovereignty over desktops, sessions, logs, and user governance, enabling multi-cloud flexibility without “Hotel California” lock-in.

Experience It Live

A browser-native trading desktop can be launched in minutes. No agents. No installers. No VPN. Just login, authenticate, and experience a GPU-accelerated financial desktop from your browser.