If your 2025 IT budget still includes more than $1.5 million of tower hardware, you’re not modernizing—you’re preserving an outdated operating model. Capital markets are under intense pressure to reduce fixed costs, support hybrid traders, and meet increasingly strict energy-efficiency and ESG mandates. Yet most trading floors still pour money into physical trading towers, refresh cycles, multi-monitor devices, and desktops that consume hundreds of watts per seat.

The result is a structural P&L drag.

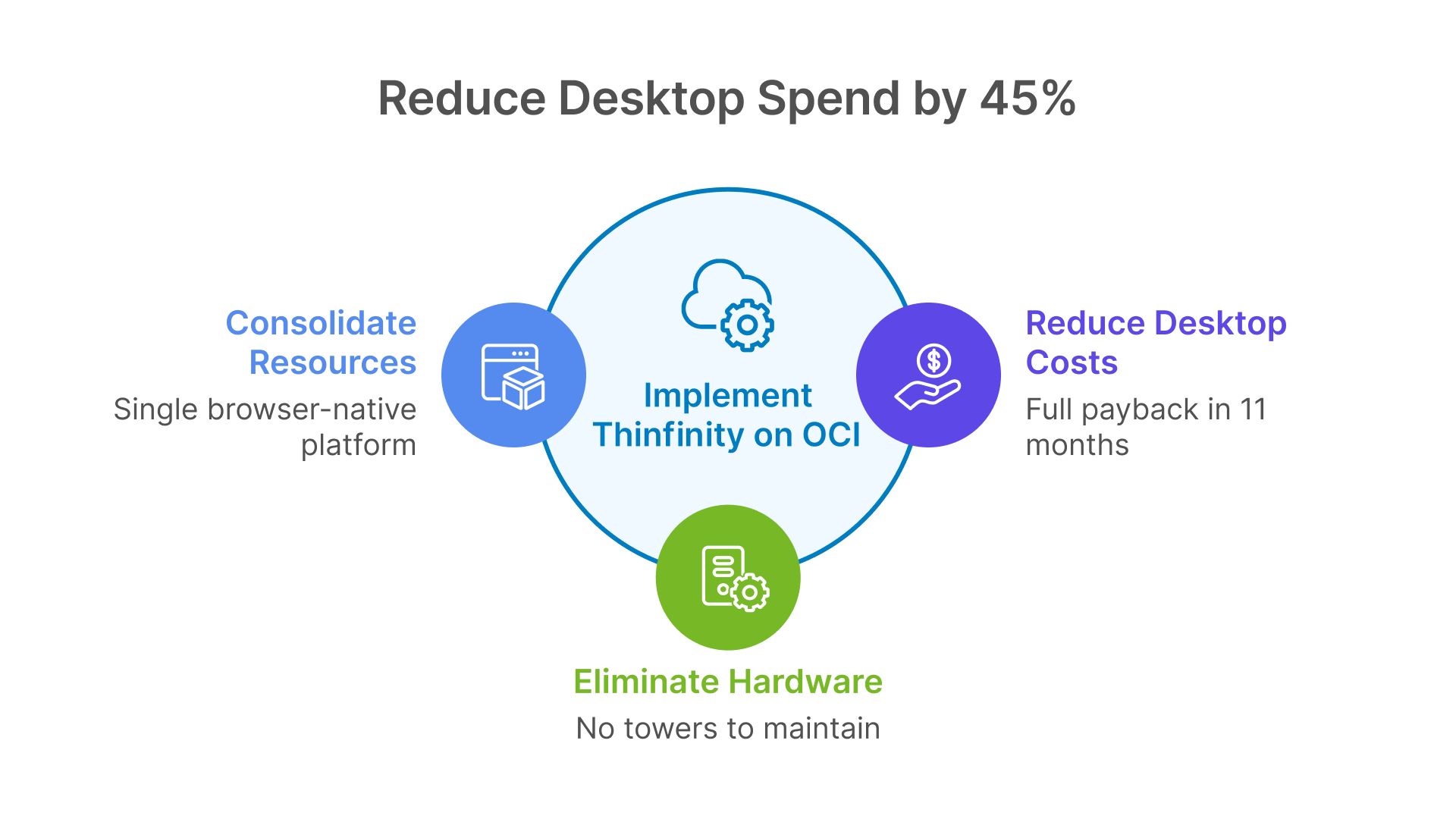

Our Financial VDI TCO Model for 2025, validated with CFOs and CTOs across three tier-1 banks, shows that Thinfinity on Oracle Cloud Infrastructure cuts run-rate desktop expenses by more than 45% compared to Windows 365 and more than 55% compared to physical towers. Even more compelling, firms achieve full payback in 11 months, with savings compounding every year thereafter. For trading floors facing constant cost pressure and M&A-driven headcount volatility, this isn’t just an efficiency gain—it’s a strategic advantage.

For a broader view on browser-native trading desktops and architecture benefits, see our deep-dive guide.

The Real 3-Year Cost Picture for a 500-Seat Trading Floor

Across a three-year planning horizon, the economics of desktop delivery in financial institutions diverge dramatically depending on the model selected. Physical trading towers, once considered “the safe option,” have become one of the most capital-intensive and operationally rigid choices. Their cost structure is dominated by high-end workstation purchases, multi-monitor arrays, energy and cooling consumption, deskside engineering labor, and an increasingly complex compliance footprint.

Windows 365 with GPU shaping appears modern on the surface, but its economics break quickly at scale. Double licensing, GPU scarcity, quota constraints, and cross-cloud egress charges push real-world costs into the $12.5M range for 500 front-office seats.

Thinfinity on OCI takes a fundamentally different approach. By consolidating GPU acceleration, compute, identity, storage, and compliance into a single browser-native platform, firms eliminate endpoint hardware entirely. There are no towers to maintain, no multi-monitor refresh cycles, no home-office troubleshooting tickets, and no energy penalties.

To clarify the difference, here is the final 3-Year TCO Model for a 500-seat credit or trading desk:

Three-Year TCO Comparison — 500 Trading Desktops

| Deployment Model | 3-Year Cost | Notes |

|---|---|---|

| Physical Trading Towers | $7.6M | Highest operational overhead. Energy-intensive. Requires deskside support and hardware refresh cycles. |

| Windows 365 + GPU | $12.5M | Double licensing. GPU quota limitations. High egress fees. Not designed for latency-critical workloads. |

| Thinfinity on OCI | $3.5M | Browser-native delivery with centralized governance, GPU pooling, and near-zero endpoint TCO. |

Hidden Savings Finance Leaders Miss

Many organizations focus on headline hardware prices but overlook the continuously accruing operational costs that dominate financial desktop TCO. Modern trading floors carry a heavy ESG and P&L burden from energy consumption, cooling requirements, and physical hardware management. Thinfinity on OCI collapses many of these categories entirely.

Power and cooling consumption drops by 65%, a reduction that shows up in both raw OpEx and Scope-3 reporting. On-floor engineering incidents fall by more than 80% because nothing sits under the desk, nothing overheats, and nothing requires a physical touch. And rather than maintaining a five-year refresh cycle for expensive towers, firms shift to lightweight, inexpensive endpoints that can be replaced for a fraction of the cost, or in many cases eliminated altogether with browser-native access.

For finance leaders, these hidden savings often exceed the cost of the cloud desktops themselves.

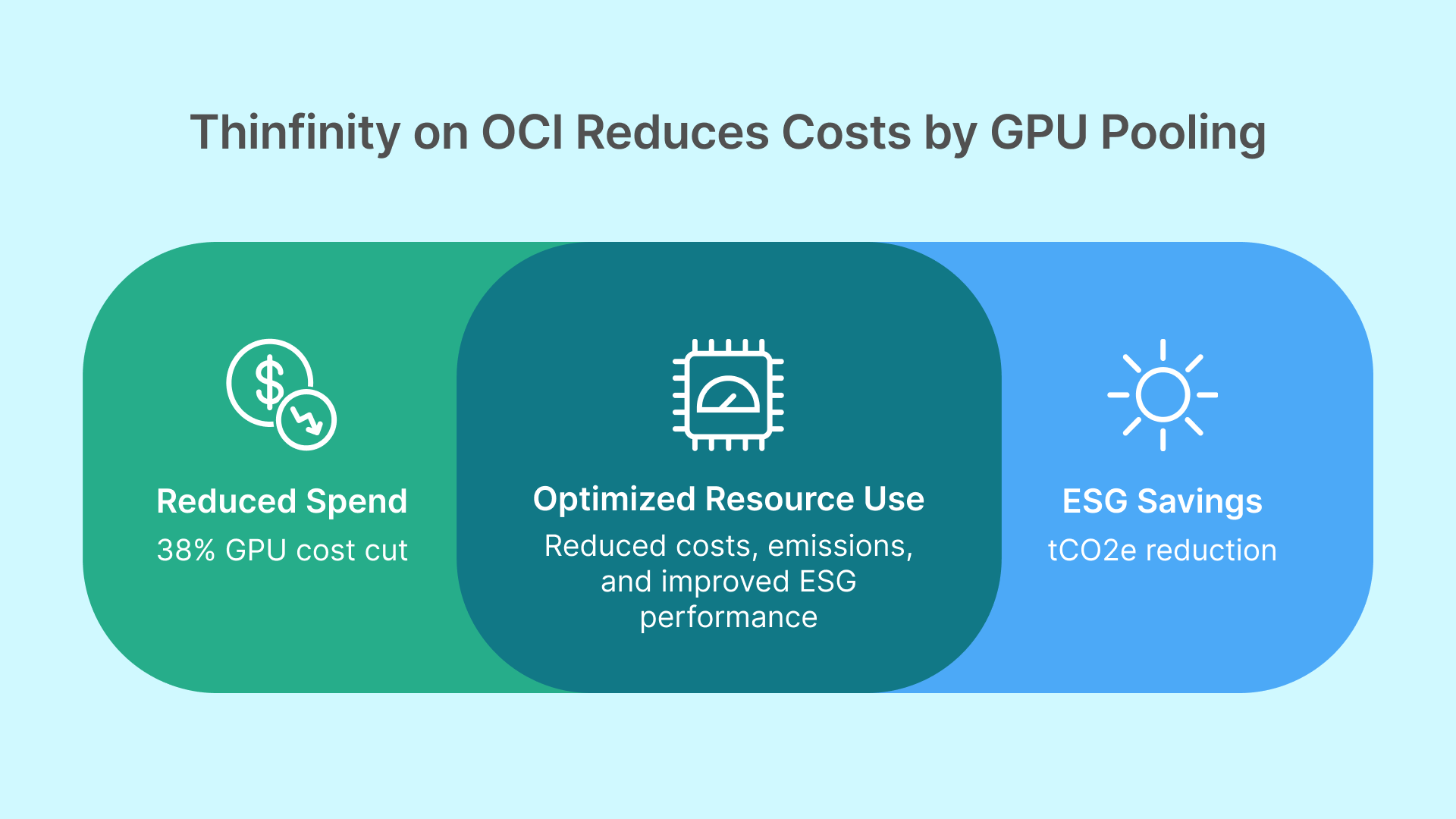

GPU Pooling: The Largest Source of Economic Gain

In capital markets, GPUs are the most expensive component of a virtual desktop program. The reason Thinfinity on OCI outperforms traditional VDI and Windows 365 is simple: pooling.

Instead of dedicating a GPU to each trader—an approach that results in 60–70% idle consumption—Thinfinity dynamically pools GPU resources across the entire user base. In a 500-seat environment, this means replacing the assumption of 500 allocated GPUs with a realistic utilization model: roughly 80 OCI A10G instances can support the full floor with peak-hour headroom.

This alone reduces GPU spend by 38%, while maintaining the sub-10 ms latency and 60-fps frame pacing needed for Bloomberg, Eikon, Excel modeling, and real-time pricing.

Across three years, GPU pooling becomes the single biggest lever in cutting desktop cost.

Quantifying ESG Savings in Trading Workloads

The ESG impact of removing physical trading towers is not theoretical—it is measurable. A typical trading workstation and four 4K monitors can draw more than 200 watts continuously, consuming thousands of kilowatt-hours annually.

Eliminating these devices across 500 traders removes more than 220 tCO₂e over 36 months.

To put this in perspective: It is the equivalent of eliminating 540 transatlantic flights from New York to London.

For banks under regulatory and investor pressure to reduce emissions, this shift is one of the clearest and fastest ESG wins available in the digital infrastructure stack.